Documents Required for GST Registration

All persons classified as taxable person under GST are required to obtain GST registration and begin filing GST monthly returns from the month of September, 2017. In this article, we look at the list of documents required for GST registration in India.

Who Should Obtain GST Registration?

Any persons or entity providing taxable supply of goods or services to persons in India with an annual aggregate turnover of more than Rs.20 lakhs is required to obtain GST registration. In some special category states like Assam, Nagaland, Manipur and other, the aggregate turnover criteria has been reduced to Rs.10 lakhs. Other than the aggregate turnover criteria, a person could be required to obtain GST registration, if they undertake inter-state supply of goods or services or have an existing VAT or service tax or central excise registration.

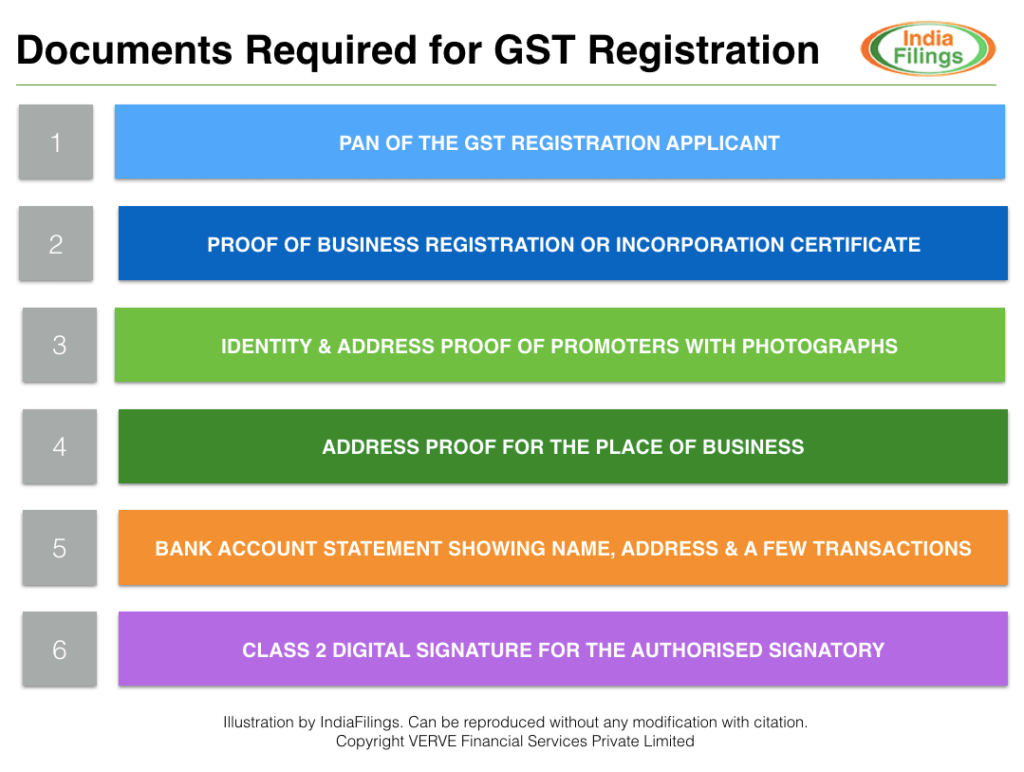

GST Registration – Documents Required for Regular Taxpayers

The following documents must be submitted by regular taxpayers applying for GST registration.

PAN Card of the Business or Applicant

GST registration is linked to the PAN of the business. Hence, PAN must be obtained for the legal entity before applying for GST Registration.

Identity and Address Proof along with Photographs

The following persons are required to submit their identity proof and address proof along with photographs. For identity proof, documents like PAN, passport, driving license, aadhaar card or voters identity card can be submitted. For address proof, documents like passport, driving license, aadhaar card, voters identity card and ration card can be submitted.

- Proprietary Concern – Proprietor

- Partnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all partners are to be submitted but photos of only ten partners including that of Managing Partner are to be submitted)

- Hindu Undivided Family – Karta

- Company – Managing Director, Directors and the Authorised Person

- Trust – Managing Trustee, Trustees and Authorised Person

- Association of Persons or Body of Individuals –Members of Managing Committee (personal details of all members are to be submitted but photos of only ten members including that of Chairman are to be submitted)

- Local Authority – CEO or his equivalent

- Statutory Body – CEO or his equivalent

- Others – Person(s) in Charge

Business Registration Document

Proof of business registration must be submitted for all types of entities. For proprietorships there is no requirement for submitting this document, as the proprietor and proprietorship are considered the same legal entity.

In case of partnership firm the partnership deed must be submitted. In case of LLP or Company, the incorporation certificate from MCA must be submitted. For other types of entities like society, trust, club, government department or body of individuals, registration certificate can be provided.

Address Proof for Place of Business

For all places of business mentioned in the GST registration application, address proof must be submitted. The following documents are acceptable as address proof for GST registration.

For Own premises

Any document in support of the ownership of the premises like latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

For Rented or Leased Premises

A copy of the valid rental agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill. If rental agreement or lease deed is not available, then an affidavit to that effect along with any document in support of the possession of the premises like copy of electricity bill is acceptable.

SEZ Premises

If the principal place of business is located in an SEZ or the applicant is an SEZ developer, necessary documents/certificates issued by Government of India are required to be uploaded.

All Other Cases

For all other cases, a copy of the consent letter of the owner of the premises with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also, the same documents can be uploaded.

Bank Account Proof

Scanned copy of the first page of bank passbook or the relevant page of bank statement or scanned copy of a cancelled cheque containing name of the Proprietor or Business entity, Bank Account No., MICR, IFSC and Branch details including code.

Digital Signature

All application for GST registration must be digitally signed with a Class 2 Digital Signature. Hence, its important that digital signature be obtained for the following person who is authorsised to sign the GST registration application before beginning the application process. (Know more about Digital Signature Requirement for GST)

Click here for more info

Thanks for sharing useful content. Value Added Tax Registration is a tax registration required for businesses trading or manufacturing goods in UAE. vat registration uae

ReplyDeleteAny company with an annual revenue of over Rs 40 lakhs must register as a distinct taxable provision under GST registration, and GST registration is quick and easy online in India. Businesses must register as distinct taxable provisions in compliance with GST jurisdiction when their revenue exceeds Rs 40 lakhs. To accomplish this, you must register for GST. In India, GST registration normally takes two to six working days.

ReplyDeleteYou avoid needless expenses that you would have incurred when filing your taxes manually when you file electronically. You can also check out about Income Tax E Filing here.

ReplyDeleteFormLLC provides quick U.S. company setup, trustworthy compliance guidance, and smooth support, helping entrepreneurs launch and grow their businesses without stress.

ReplyDeletehttps://formllc.co.in/